Bio

Federico Bertocchi, in 2014, graduated from the Genoese high school “Marin Luther King”.

In October 2019, he graduated in Law with honors from the University of Genoa, discussing a thesis in International Tax Law, entitled “The residency in the international conventions against double imposition”; supervisor: Prof. Avv. Antonio Lovisolo.

After few months as a stagier at the Internal Revenue Agency and at the Customs Agency, he started collaborating with firm Lovisolo & Partners Avvocati as a trainee lawyer, examining International Tax Law and national Tax Law’s issues, related to individuals as well as companies.

In 2019, he won a scholarship for an Executive Course in International Tax Law (II ed.) held in a Milan-based International Tax Law firm.

In October 2019 he won a scholarship for the Master “Vat and Customs” held by IlSole24Ore Business School, also assuming the role of “tutor” of the Master.

Since the beginning, he has actively taken part in the activities of the scientific journal “Diritto e Pratica Tributaria”, founded by Professor Victor Uckmar and directed by Professors Cesare Glendi and Antonio Lovisolo.

He has also published scientific articles concerning Tax Law, International Tax Law and Customs Law.

In 2020, as the first ranked candidate, he won a scholarship for a PhD course in Tax Law and International Tax Law at the University of Bergamo.

In 2021 he has been appointed as a member of the Editorial Board of the scientific journal “Diritto e Pratica Tributaria”.

Also in the same year, he was called to the Bar in Genoa.

Languages: Italian & English.

Publications

Notes on sentences and comments

- Bertocchi Federico, articoli 27, 28, 29, 30 e 31 D.Lgs. 546/92 in “Commentario breve alle leggi del processo tributario”, Consolo – Glendi, Cedam, Padova, 2023Bertocchi Federico, Il regime fiscale delle “provviste di bordo”: condizioni tecnico-giuridiche per definire una nave come “in partenza” da un porto nazionale, Rivista di diritto tributario (suppl. online), 11 ottobre 2021.

- Bertocchi Federico, La disciplina della residenza fiscale: i criteri dell’iscrizione anagrafica e della sede legale ed il loro formalismo, alla luce dell’evoluzione tecnologica e dei nuovi modelli di attività economiche, Diritto e Pratica Tributaria, CEDAM, 2/2021, pag. 682.

- Bertocchi Federico, La “residenza” delle persone fisiche nell’ambito delle Convenzioni internazionali contro la doppia imposizione fiscale, Novità Fiscali, 2020, 6

- Bertocchi Federico, L’Iva e le importazioni irregolari di beni, Diritto e Pratica Tributaria, CEDAM, 1/2020, pag. 295.

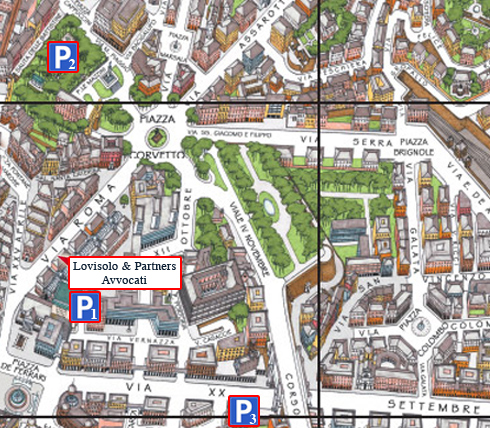

WHERE WE ARE

PARKING

![]() P.zza Piccapietra 58/a

P.zza Piccapietra 58/a

![]() V. Martin Piaggio 11/r.

V. Martin Piaggio 11/r.

![]() V. D'Annunzio 6

V. D'Annunzio 6

P.I. 00690960109

LOVISOLO & PARTNERS Lawyers - All rights are reserved ©2021